September celebrates the awareness of pet insurance as a part of Pet Awareness in the lives of pet owners.

The pet insurance month, started by The North American Pet Health Insurance Association (NAPHIA), marks the importance of insurance in the lives of innocent pets.

Less than 3 million pets in the US are insured against 80 million uninsured pets, which is less than 4% of total owned pets. The number pales compared to the UK and Sweden, where insured pets are 25% to 40%.

Taking up pet insurance is more than essential because many pet owners fail to provide emergency medical care to their pets when needed.

The rising vet bills will make it even more difficult for pet owners to afford primary pet care in the future.

Thus, pet insurance will save you from costly pet bills and cover basic to emergency pet care whenever needed. It can help you make better decisions about your pet's health based on your finance.

What Does Pet Insurance Cover

Depending on the policy, pet insurance will cover every medical, surgical, illness, and regular test up to 90% of the costs.

According to NAPHIA report,

When a claim was paid in 2018, an accident and illness policyholder received an average of $284.

However, not every insurer will cover up to 90% of the costs. Hence, always compare different insurers and policies when buying pet insurance.

Depending on the type of coverage and the insurer you choose, the insurance will cover the following:

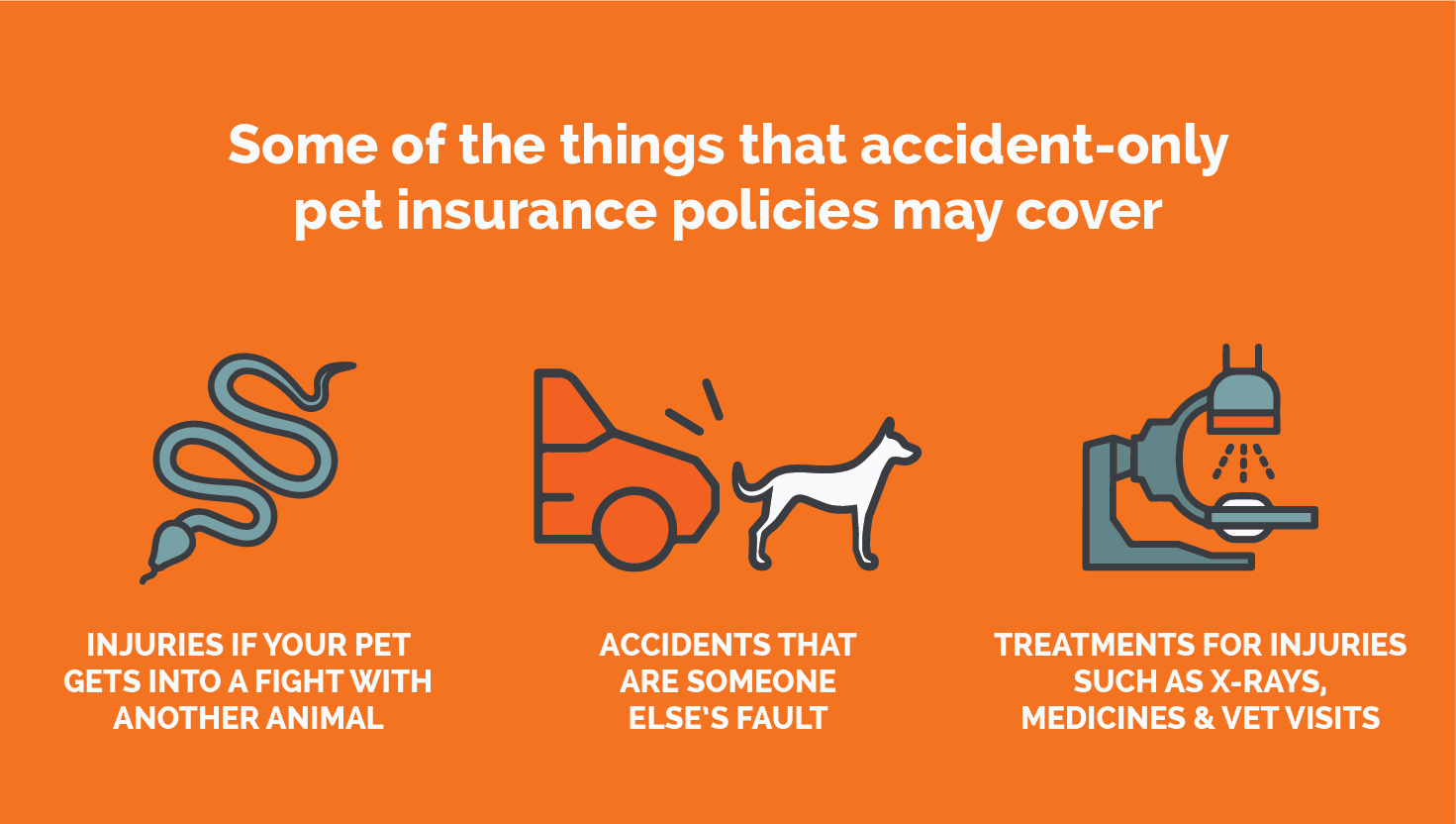

1. Accident Only

This policy only covers physical accidents, including poisoning, cuts and lacerations, fractures, bloat, and surgery required from accidents.

However, it may not cover preexisting conditions in your pet or illness, intentional injuries, and poising in certain circumstances.

One significant advantage of taking accident-only coverage is the affordable monthly premiums, but it will not cover those regular visits to the vet that are more common in pets.

Accident-only policies reimburse the cost of treating injuries or illnesses caused by mishaps, whether they are the animal or its owner's fault.

2. Accidents and Illness

This type of insurance policy covers both accidents and illnesses, including physical accidents, injuries, vet-diagnosed sickness or disease (Cancer, dip Dysplasia), prescription medicines, surgery, and alternative therapies.

However, it may not cover preexisting conditions, routine vet care, dental problems, and certain prescription medications.

Some policies will also deny covering pets over a specific age limit.

You would have to pay slighter higher premiums for this coverage, and reimbursements are capped per accident or illness.

3. Wellness Coverage

Often called "preventive care," wellness provides coverage routine veterinary care, vaccination, flea/tick and heartworm preventatives, microchipping, and spay/neutering surgery.

However, it may not cover accidents and illness.

How Does Pet Insurance Work?

Unlike what most policyholders believe, pet insurance does not work like traditional insurance.

You would pay directly to the vet and get reimbursed by the insurer for a percentage agreed via your insurance policy.

According to NAPHIA 2018 report,

The average annual premium in the United States for accident and illness coverage was $566 for dogs and $354 for cats. Accident-only plans cost an average of $190 for dogs and $141 for cats.

The insurer will cover the expenses mentioned in the policy. For example, suppose you have taken an accident-only approach. In that case, the insurer will not cover the costs for the treatment of illnesses.

Medical costs are arguably the most expensive aspect of owning a pet. The average vet bill could run anywhere from $50 to $400 every year.

Unfortunately, none of those mentioned above insurance policies cover dental illness and treatment because it tends to be expensive and recurring.

However, accident only and accident and illness policy will cover dental expenses if the teeth were injured by accident, such as biting or chewing on something or from physical accidents.

What Determines the Pet Insurance Coverage?

For pet insurance, your premium is calculated using a combination of factors, including:

- Pet's age

- breed

- your locality/location

- De-sexed/spayed status

- gender

- Animal type (dog or cat).

The coverage will further delve into policy types such as accident-only, accidents and illness, wellness, dental, and insurance provider.

However, you can still find ways you can save on pet insurance.

- Compare policies between two providers by comparing the coverage vs. benefits and cost.

- Insure your pet from a young age to prevent any chances of preexisting conditions that are often not included in the insurance policy.

- Increase your "excess payment," the payment you directly make to the vet towards a claim, to get a cheaper annual premium.

- Purebred dogs are expensive to insure than smaller or mixed breeds because certain breeds are more likely to have health issues due to genetic predispositions.

Is Your Pet Eligible to get an Insurance Coverage?

Like mentioned before, your pet's eligibility for insurance coverage will depend on its breed, age, location, and other vital information.

For instance, the insurances do not cover preexisting conditions, illnesses, or medical conditions.

Suppose you try getting insurance that will cover your dog's existing heartworm problem or hip dysplasia. In that case, they will simply not cover it.

Another vital factor is the waiting period. The insurer will wait for a specific period (generally, 14 days) before you can obtain insurance after your pet has been diagnosed with a medical issue.

Pet Insurance Providers

Here is a comprehensive list of pet providers based on their scope of coverage, flexibility, and exclusions.

AKC Pet Healthcare plan is available in all the states. The Markel Insurance Company of Virginia underwrites its plans.

- It offers five different plans that range from basic accident and injury to wellness.

- The Wellness Plus Plan reimbursed 80% of eligible medical and accidental related conditions.

- Some common illnesses, including diabetes, chronic renal failure, and cardiomegaly, are excluded.

ASPCA Pet Health Insurance is one of the most opted insurers in the country. Developed in 2006, all of its policies are underwritten by United States Fire Insurance Company.

- It offers four plans with single incident benefit limits between $2500 and $7500.

- The Wellness benefits are available for two of the four plans, which reimburses from $280 to $530 per year.

- It excludes covering congenital conditions.

The Ohio-based Embrace Pet Insurance was founded in 2003. The American Modern Insurance Group or RLI Insurance Company underwrites its plans.

- You can get customizable plans based on multiple annual limits, deductible options, and different levels of reimbursements (65% to 90%).

- It also offers supplemental allowance plans for wellness and dental care.

A Washington-based Healthy Paws Insurance started its operations in 2010. The Markel American Insurance Company underwrites its plans.

However, it only offers one plan with reimbursement rates ranging from 70% to 90%.

- The standalone plan also covers congenital and hereditary conditions as long as they have not been diagnosed previously.

- As a rule, the pets must be enrolled to six years of age for hip dysplasia.

- Additionally, vet examination fees, no accidental dental, alternative therapies, and prescription diets are excluded.

An Indiana-based Pet First Healthcare first started its operations in 2005. The American Alternative Insurance Corporation underwrites its policies.

- You can choose from several prepackaged standard plans or customizable plans.

- The Family Plan Policy allows pet owners to cover up to 3 pets under a single policy.

- However, it excludes coverage of breeding and congenital disabilities, wellness, preventive and dental care, treatment of internal parasites, and cruciate diagnosis.

Conclusion

The pet's life will shorten if you fail to provide preventive and emergency medical care when needed.

Pet Insurance will ensure to keep your pet covered for any medical or preventive treatment as it occurs.

However, do not forget to compare plans against your need before buying a specific insurance policy.

Get in touch with Urban Pet Hospital & Resort, the best pet hospital in Urbandale.